A coat made from recycled fabric by Finnish company Infinited Fiber. Fanny Haga/TBWA/Handout via REUTERS Acquire Licensing Rights

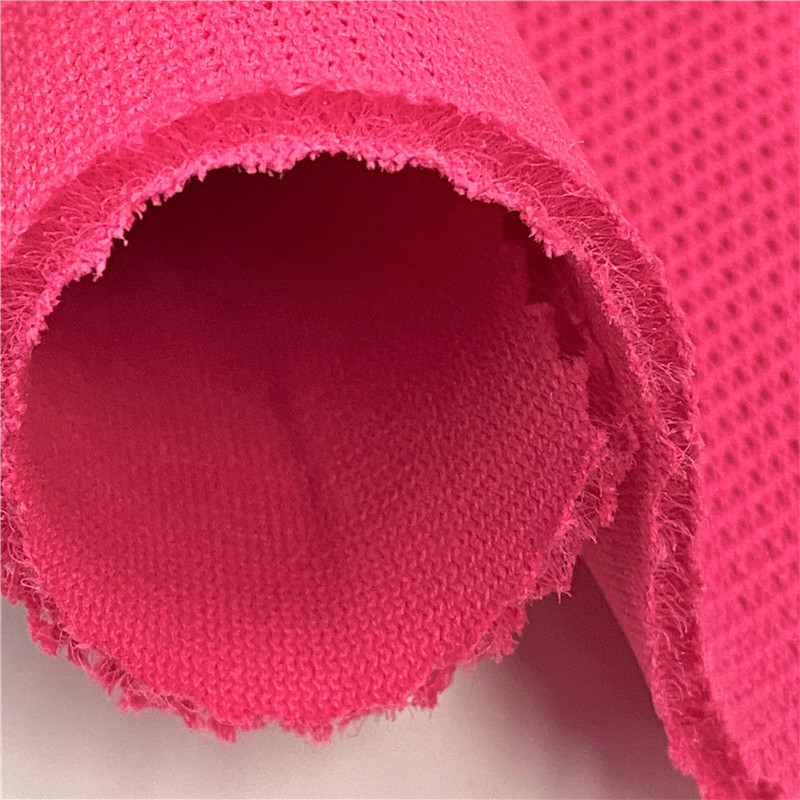

August 24 - There’s probably enough clothing on the planet that there’s no need to spin another new fibre. In the United States and European Union almost 22 million tonnes of textiles are thrown out every year. The waste is found everywhere from the ocean to the Atacama Desert. Polyester Activewear

Much of what’s discarded in the Global North is exported to become someone else’s problem in the Global South. If we’re to have a circular economy, the billions of tonnes of existing textiles will have to be recovered and recycled at scale. And that’s a challenge that reaches into every part of the supply chain.

Brands and retailers have the power to make it happen, and regulation is pushing them.

Some U.S. states are advancing legislation on textiles recycling, while proposals launched by the EU in July will make producers responsible for the full life cycle of textile products, also known as extended producer responsibility. They’ll have to cover the costs of managing textile waste, a measure aimed at incentivising them to produce less waste and design for circularity.

Ecodesign legislation is also in train, as part of an overall vision to have textiles on the EU market both recyclable and largely made of recycled fibres by 2030, while another proposal aims for common rules on environmental claims to prevent greenwashing.

Current legislation also means member states will have to collect textiles separately from 2025.

A role of fabric made from plastic bottles at a monastery in Bangkok, Thailand. According to Textile Exchange, 99% of recycled polyester is made from plastic bottles, which could be better utilised by the drinks industry. REUTERS/Soe Zeya Tun Acquire Licensing Rights

Viviane Gut, senior director sustainability at Adidas, says the proposed regulations, taken together, bring clarity to a situation where “every brand almost has their own definition of what is sustainable or circular. Extended producer responsibility doesn’t solve the problems of textiles recycling, but it creates an environment where you are clear what you know, what you can do and what you should do. So we are all working in the same direction, and trying to solve this very complex topic.”

Today just 1% of materials in clothing is recycled into new textiles. This stands in marked contrast to the findings of Sorting for Circularity Europe, a project developed by Fashion for Good. Its snapshot of textile waste across six European countries suggests 74% of post-consumer textiles – some 500,000 tonnes – was available and suitable for recycling. Potentially this is worth some 74 million euros if reintroduced into the garment industry’s value chain.

And while it has a database of 100 mechanical and chemical recyclers worldwide, scale is lacking.

According to Textile Exchange, 99% of recycled polyester is made from plastic bottles, or PET, putting the fashion industry in competition with the drinks bottle industry, where (in theory) the plastic can be recycled many more times.

This practice may fall foul of the EU’s proposed Green Claims directive, which says that claims that using recycled PET is environmentally beneficial would be misleading “if the use of this recycled polymer competes with the closed-loop recycling system for food contact materials, which is considered more beneficial from the perspective of circularity”.

Adidas won’t put a timeline on moving away from recycled bottles to recycled textiles. While using them contributes to reducing the company's carbon emissions, “We’re well aware that this is not the end solution,” says Gut. However, “there’s simply not enough volume (of recycled fibre) out there to create products” or to test them. “There's no sense in creating a product that falls apart when you wash it the first time, so it also needs to be durable.”

Inditex brand Zara has a capsule collection made with recycled cotton produced by Infinited Fiber. Infinited Fiber/Handout via Reuters Acquire Licensing Rights

Richard Wielechowski, who heads the textiles programme at financial think tank Planet Tracker, says it comes down to brands being prepared to invest in innovation.

“We desperately need development in this space, but it's not cheap. One of the problems is a lot of the virgin fibres are so cheap that they make being economically competitive by doing recycling really quite difficult,” says Wielechowski.

“You could argue brands are currently chucking away what could be a valuable asset if there was actually a circular system that they could feed it back into.”

While the textile feedstock is there, the different materials have to be sorted and separated, and even then, what’s labelled as cotton or polyester may be mixed with other materials like rayon or Lycra, have coatings, zippers or buttons and will almost certainly be dyed.

For Dutch polyester recycler CuRe Technology, this means verifying the composition of all materials coming into its pilot plant. It’s created a dashboard of non-polyester components its process can and can’t cope with.

Josse Kunst, the company’s chief commercial officer, says CuRe is focusing first on pre-consumer textile waste, as well as post-consumer waste collected with brand partners. To make the move to publicly collected textiles, sorting needs to dramatically improve.

Garment workers cut fabric to make shirts at a textile factory in Andhra Pradesh, India. The design stage can have the biggest impact on a garment's circularity. REUTERS/Samuel Rajkumar Acquire Licensing Rights

“If you go to textile collectors (and) say ‘give me 100% polyester’, you may be lucky if it's 80% polyester, simply because the sorting systems are not yet accurate enough. We can't put 80% in our plant and still think that chemistry-wise, it's 100%. It doesn't work like that.”

Design is where the recycling process should really begin. “Designers have the biggest impact on circularity, but they tend not to know enough of chemistry and their impact on recyclability, so we already start wrong,” Kunst suggests.

Adidas doesn’t yet have specific briefs for circularity to give to its designers but is working with CuRe Technology and Finnish cotton recycler Infinited Fiber, alongside sorters and yarn manufacturers, in an EU-funded project, T-REX, to come up with a design approach that will fit with emerging technologies.

“We want to have an approach to how we design our products that we are sure all of them are able to be included in this big loop of different players – sorting and recycling and making new fibres,” Gut says.

Kathleen Rademan, innovation director at Fashion for Good, says the sustainability challenge for the industry is huge: “It's like, if you run a giant restaurant, and somebody says ‘Your whole menu has to change. Everything now needs to be orange and green, and you can only source from this country’, and you're creating these very strict parameters that you have to abide by.”

Effecting change through the supply chain is also particularly difficult in the fashion industry, she says, because it “is an extremely dense, very fragmented industry with lots of stakeholders”.

That means brands are starting slowly with product categories that lend themselves to change, and working directly with recyclers. Patagonia sends used garments to Japan’s Jeplan, whose chemical recycling process produces fibres for one range of fleeces; both Adidas and Inditex brand Zara have capsule collections made with recycled cotton produced by Infinited, while Zara also recently announced a collection made from recycled fibres from polycotton waste, developed by U.S. company, Circ.

A worker drives a forklift past sacks of polyester-making chemicals waiting to be shipped in Dalian, Liaoning province, China. REUTERS/Chen Aizhu Acquire Licensing Rights

In Infinited’s system, cellulose is liberated from cotton. Part of the following processing is similar to viscose production, but without the hazardous chemicals that make viscose unsustainable, says chief marketing officer, Tanja Karila. It can also handle lower-quality sorted textile waste, provided the cotton content is at least 88%.

The company’s first commercial plant, expected to require 400 million euros investment and slated for 2026, will be producing 30,000 tonnes of recycled fibre. Yet Infinited’s analysis of brand sustainability commitments, as well as consumer demand, suggests 4.5 million tonnes of cotton-like recycled fibre will be required in 2030.

“So you can see the gap – even all the announced capacity from industry peers doesn’t fulfil the demand,” Karila notes. While Finland is already collecting textile waste, it expects to import from other countries as well as directly from brands’ own take-back schemes.

A third of Infinited’s projected offtake has already been bought up by Inditex, in a deal worth around 100 million euros.

Infinited is waiting for the results of an independently assessed life cycle analysis for its Infinna fibre but can claim its production uses a fraction of the water consumed in growing and processing new cotton.

CuRe asserts a greater than 80% lower carbon footprint than virgin polyester – producing 0.3kg of CO2 per kilo compared with around 2.2kg CO2 per kg of new polyester fibre. CuRe’s process doesn’t break the polyester polymer right down into its monomer building blocks, but far enough to purify it, before reconstituting the polymer so it can be spun back into fibres. “The simple reason why is energy,” explains Kunst. “We call it the 80:20 rule, breaking down polyester 80% costs you only 20% of the energy.”

The challenge is convincing the yarn makers, some of whom are resisting anything but virgin fibre or recycled PET bottles, as recycled fibres are not an exact drop-in. There are also higher costs, which brands and consumers will have to bear.

Karila of Infinited points out that fibre makes up only a small proportion of final product cost – in the case of a 15 euro T-shirt, around 5%. “Rather than talking about cost, I would talk about value,” she says. After all, recycled fibres enable brands to make some progress on the journey to meet water, biodiversity and carbon targets – externalities they’ve never had to price in before.

Gut envisages it will take until 2030 and beyond to achieve textile-to-textile recycling at scale. Until then, some means of stemming the flow of garments onto the discard pile has to be found. But as the latest Fashion Transparency Index finds, just two out of 250 brands investigated have made commitments to degrowth. Unless many more agree to make fewer garments the recycling challenge is only going to grow.

This article is part of the latest issue of The Ethical Corporation magazine, which is about sustainable fashion. You can download the digital pdf for free here

Angeli Mehta writes the Policy Watch column for Ethical Corporation, Thomson Reuters' sustainable business magazine. She is a science writer with a particular interest in the environment and sustainability. Previously, she produced programmes for BBC Current Affairs and has a research PHD. @AngeliMehta

EU lawmakers agreed on Wednesday to draft rules requiring Alphabet's Google, Meta and other online services to identify and remove online child pornography, saying that end-to-end encryption would not be affected.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.

Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

The industry leader for online information for tax, accounting and finance professionals.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

Recycled Polyester All quotes delayed a minimum of 15 minutes. See here for a complete list of exchanges and delays.